by Ryan Pedersen & James Delhauer

We have been making movies in Hollywood for one hundred fourteen years. It began in 1910 with the release of D.W. Griffith’s Western short film, In Old California, and by the 1920s, nearly 90% of all films were produced in California. Throughout the twentieth century, the entertainment industry helped grow the state’s economy into one of the largest in the world. However, times have changed. Filmmaking is now a global industry with annual revenues between $90 billion to $100 billion. Every locality is trying to capture a bite of that pie, luring productions to film in their regions with large tax incentive programs that offset the cost of producing movies and television. This has led to a drought of work in California. Tens of thousands of workers and their families are struggling as the industry has migrated to other areas. So, let’s talk about the California Film & Television Tax Credit Program.

In order to combat runaway production, California introduced its first incentive program in 2009. It offered $100 million annually in tax credits based on qualified expenditures to help keep productions in the Golden State. The program was expanded in 2015 to Program 2.0 which increased the allocation to $330 million annually, as well as introducing a competitive application process. In 2020, Program 3.0 increased the program’s scope to appeal to a broader range of productions. This program was set to expire in 2025, but in 2023, California labor unions lobbied to expand the program for an additional five years. This secured funding through 2030 and introduced additional refundability provisions.

The California Film & Tax Credit Program is managed by the The California Film & Tax Credit Program is managed by the California Film Commission (CFC). This group oversees the application process, eligibility requirements, and allocation of tax credits to film and television productions. The CFC also helps producers navigate the program requirements. They work in conjunction with the California legislature and other state departments to ensure that the program is meeting its goals. The Tax Credit Program is rather extensive and contains many provisions that would take pages and pages to explain in this article so for your sake and ours, we will give the basic highlights of the program to aid in your understanding in what the tax credit does and how it works.

The current program offers a 20%-25% credit on production spending and up to 30% on labor costs. A production must spend at least $1 million in the state and each project has a tax credit cap of either $20 million or $25 million. To qualify for a tax credit, a production must have 75% or more of their total principal photography days occur in California, with exceptions for capturing backgrounds, VFX, action and/or crowd scenes by second; stunt; or VFX units. They must also spend 75% of their production budget for goods, services, and wages within California.

In an economic study assessing the impact of the program between 2015 and 2020, the Los Angeles County Economic Development Corporation found that the Film & Television Tax Credit Program had created over one hundred and ten thousand jobs in the state. The study further found that for every dollar spent, the program generated $1.07 in direct tax revenue, $8.60 in labor income for middle-class workers, $16.14 in state GDP, and $24.40 in labor activity.

Despite these successes, work continues to leave both California and the U.S. The same LACEDC study showed that revenue from 67% of productions that applied for a tax incentive and were denied relocated to other jurisdictions, resulting in losses of $1.9 billion to other states and more than $2 billion to other countries. In total, this resulted in a loss of 7.7 billion in economic activity, 28,000 jobs, and more than $350 million in direct tax revenue for the state. As of the time of this article’s writing, 40% of film and television workers in California are unemployed. This does not include workers from businesses that are adjacent to the industry that are struggling as well. Restaurants, catering companies, hospitality services, thrift shops, vendors who supply raw materials for set and costume construction, and so many others have been impacted as well.

The ripple effects of these losses should be clear. The loss of economic activity and tax revenue from the entertainment industry means a loss of state revenue for vital programs such as healthcare, education, transportation, environmental protection, and social services. These losses have the potential to cripple working-class families across the state and fuel the already out-of-control unhoused population crisis.

Thankfully, there is cause for hope. On October 27, California Governor Gavin Newsom announced his support to expand the Film & Television Tax Credit Program with a proposal to more than double its value with an annual investment of $750 million. The press conference announcing this possible expansion was heavily attended by union leaders, with the governor inviting labor to participate in making this proposal a reality. “This is a proposal, and we’ll need all of your help shaping it to work for our state’s film industry.”

As a result, the California IATSE Council—our union’s political action group in the state—has mobilized to work with elected officials in Sacramento, the Entertainment Union Coalition, and the studios to revise our existing program into a competitive, forward-thinking one that will endeavor to bring film and television work back home; not just for the good of film and TV workers and their families, but for the good of all families that participate in our state’s economy.

The governor also announced that the new program would be championed in the State Assembly by Assemblyman Rick Chavez Zbur, who has already begun working with our union leaders and other legislators to make this bill a reality.

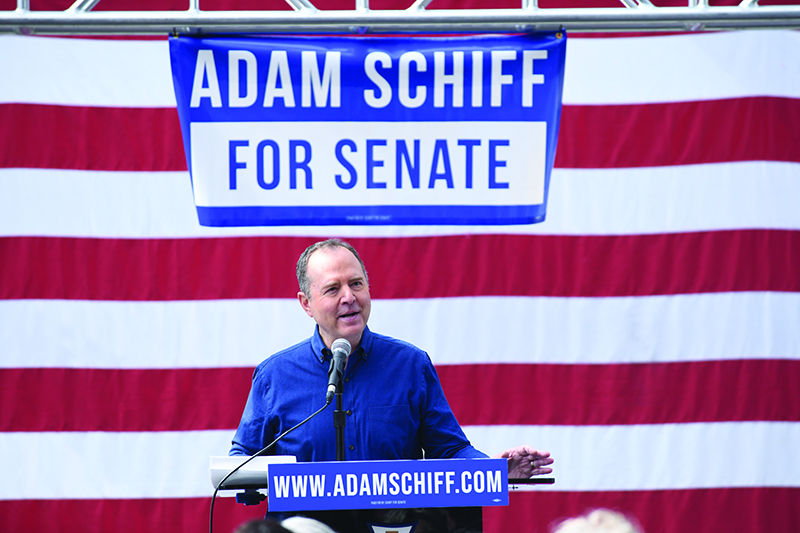

There are also plans for a Federal Incentive Plan as well. Four days after Gov. Newsom’s announcement, U.S. Congressman Adam Schiff (who California elected to the U.S. Senate on November 5), wrote a letter to the U.S. Bureau of Labor Statistics and the U.S. Bureau of Economic Analysis requesting data on employment trends within the film and television industries, stating that “In order for the U.S. to maintain its standing as a leader in the film and television production industry and spur more American jobs, we must create competitive labor-based incentives for U.S. production.” Congressman Schiff’s letter cited Australian and Canadian policies in which both their federal governments and state/province governments offer incentives that can stack with one another, noting that “major blockbuster productions have chosen to shoot in these countries rather than in the U.S, bringing with them all of the employment opportunities and investments in local economies that productions bring.”

The IATSE, which endorsed Congressman Schiff in his bid for the United States Senate and hosted his campaign kickoff event at the offices of Local 80 in Burbank, joined the congressman in urging the Bureaus of Labor Statistics and Economic Analysis to gather and release data on the impact of foreign-production incentives on U.S. jobs and local communities. “The proposal to implement a federal incentive would level the playing field and address this imbalance,” said IATSE International President Matthew D. Loeb. “We support the concept of a federal incentive for the creation of film and TV, provided the plan also has mechanisms to uphold labor standards. We are committed to saving America’s entertainment industry, and we look forward to working with our members, local unions, allies, and lawmakers at all levels to get it done.”

Many of you have been reaching out asking what can be done to help push a bill through to support incentive programs that will bring work back home. The very first thing to do is to have patience. This is the hardest part of the entire process, especially for those who are hurting from extended periods of unemployment. Following the election, the new legislative session will not begin until after the new year and once it has convened, the legislators and leaders will need time to craft specific provisions and language for the bill.

Once the bill has been written, we will need everyone’s help to write to and call their legislative representatives and tell them to support this bill. You can share your stories with them on why this bill is needed and why it will be good for California. The California Locals will be working to put together letters to state officials urging them to support expanded incentive bills. Once those become available, anyone interested in keeping and/or expanding production work in California is encouraged to reach out to your district legislators. If you choose to write your own message, Local 695 encourages you to keep your urging polite and engage in urgent, but civil discourse. After all, very few people respond well or want to help someone who is yelling at or insulting them.

We will need to show up over the next few months and the next few years as we rebuild our state’s industry. In her presidential election concession speech, Kamala Harris said, “This is not a time to throw up our hands. This is a time to roll up our sleeves. This is a time to organize, to mobilize and to stay engaged for the sake of freedom and justice and the future that we all know we can build together.” Those words are inspiring, especially given the circumstances in which she said them. At times it will seem easier to just give up and move on, but we love what we do. In order to continue on, we must continue to push forward.